Financial Accounting

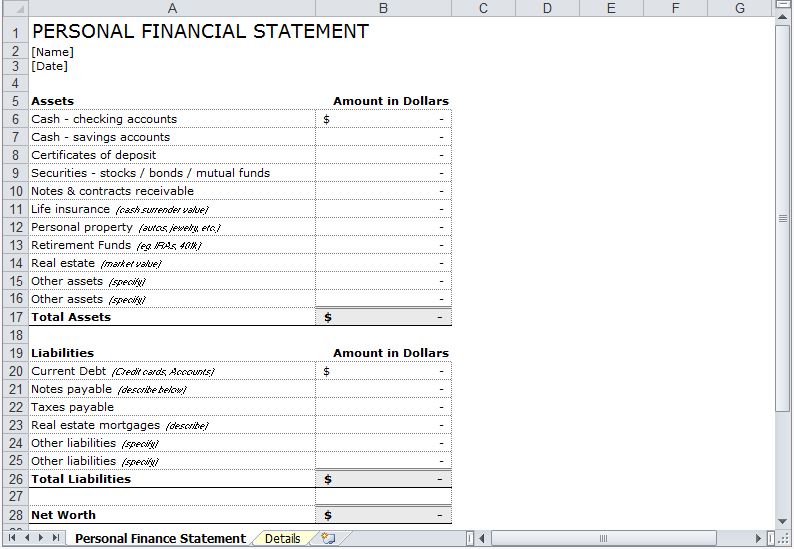

And accounting for the heartEveryone in the world should know roughly what their balance sheet and income statement look like as a family.

Gathering and compiling this data is the cornerstone of planning. Where are the holes in one’s budget and have you filled too many holes with fattening donuts? How big is your estate now and how might it grow into the future? This information shows how much life insurance is needed to cover lost income or unpayable debts. It reveals how much tax is paid and suggests planning opportunities. And it shows the potential to save and invest funds for all life’s goals.

But, were we to stand at the pearly gates, we would know that balance sheets don’t capture the heart of our lives. They don’t show risk tolerance or risk capacity, for instance, or concern for grandkids. I use a wide variety of psychological tools to grasp money values – e.g. drawings, wide ranging questions, stories, meditations – whatever works best with each client to reveal attitudes or partial truths learned in childhood which may affect our income, debts, savings and financial success.

Clients at all levels of wealth may discover themselves in four revealing categories:

- Money avoidance – Do you avoid money or consider it evil, but then underpay yourself, overspend money and live in denial?

- Money status – Do you spend more than you should just to impress others with your social standing? Have you forgotten yourself and your family in the process?

- Money worship – Does having or spending money solve all of life’s problems? Over-emphasis on this may actually impoverish you; it certainly made Scrooge deny his heart.

- Money vigilance – Are you the prudent, but sometimes overly-anxious, manager of your financial life, a hard-working person who needs no handouts and is wary of debt and willing to save and invest?

Clients at all levels of wealth may discover themselves in four revealing categories:

- Money avoidance—Do you avoid money or consider it evil, but then underpay yourself, overspend money and live in denial?

- Money status—Do you spend more than you should just to impress others with your social standing? Have you forgotten yourself and your family in the process?

- Money worship—Does having or spending money solve all of life’s problems? Over-emphasis on this may actually impoverish you; it certainly made Scrooge deny his heart.

- Money vigilance—Are you the prudent, but sometimes overly-anxious, manager of your financial life, a hard-working person who needs no handouts and is wary of debt and willing to save and invest?

The Nautilus journey into self rightly ends with better financial health and superior ability to inspire family and friends. As Socrates says:

“The unexamined life is not worth living.”

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery“- Charles Dickens, David Copperfield