Tax Audits and Letters

Games of Legal Strategy with the IRS and FTBThe IRS describes its audit as “…a review/examination of an organization’s or individual’s accounts and financial information

to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct.” Secret formula alone reveals those most likely to be audited. Do you know the rules of play and rules of delay? You have certain rights of defense and ways to mitigate damage, but the end game is predetermined by laws that must be understood.

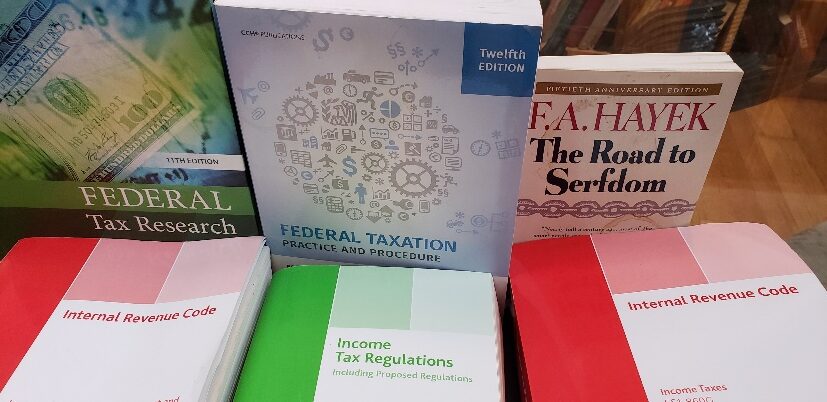

And who better to understand them than a professional researcher in history and politics at Berkeley, Oxford, and Chicago who grew up with the law? On representation, I am not just cheaper, I am also better for any task outside of tax court — and I’ve argued cases to the doors of tax court.